Last week’s bitcoin price report

signed off with this forecast:

“This week bitcoin is bearish in the immediate short term, with targets

for a low rebound at $400, and an allowance to $385.”

This week, bitcoin markets moved precisely as forecast, down to a low

$382 on Bitstamp. The price gradually fell off a cliff on March 14 at

16:00 UTC, drifting lower over the next 24 hours till $382, accompanied

by high volume on the 2 hourly chart above. As of writing this, a

retracement is taking shape, with buy and sell orders settling at

$406.

Sentiment amongst traders has quickly turned bearish, in part due to

their short term mental models. On a longer monthly period, not much has

changed as this move was mostly expected, and has occurred at least 2

previous times since November 2015 $504 peak high.

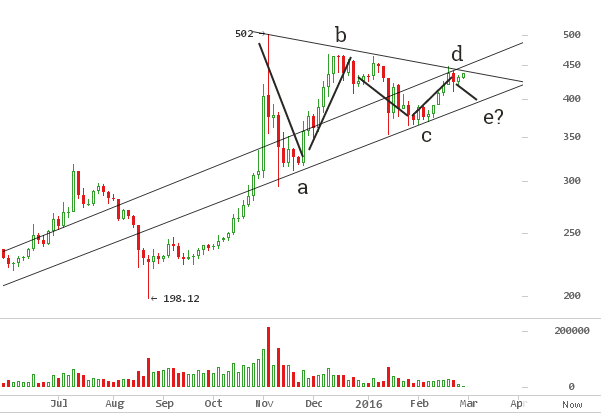

While of different magnitudes, (1), (2) and this week’s (3) have drawn

similar reactions from day traders. Longer period traders have focussed

on the larger high probability triangle pattern forming here. It is a

favoured count, that could well fail, but, it fits well with the pattern

emerging from these drops.

Eboard10 on

bitcointalk,

Night’s Watch by Afrikoin thread, says it is an Elliott Wave 4th wave

triangle seen below.

“Looks like a triangle is shaping up before we resume the up trend to

find a C wave top of the B wave of the full correction since the $1163

high. However, if we break the ~$380 level, BTC will likely resume the

downtrend straight away.”

This week’s decline is part of d-e, an expected fall for a while now.

Ideally, this triangle should break out to the upside, after e settles

on a reasonable support level.

“As long as the triangle holds, things should look better soon. That

poke of the lower trend line happened… Probably stopping some longs

out. We’ll soon see how it pans out.”

This according to RyNinDaclem on bitcointalk, citing Elliott Wave

guide for this pattern.

“triangle is valid to the C wave low ($352.50 but no less). I kind of

expect a failure to hit the lower trendline (something around $400),

but would not be surprised to see a slight break of it to trip the stops

that are based on that triangle”

This is one possible outcome that a lot of traders are holding their

breaths for, an upside turn in time for the 12.5 BTC halving mania.

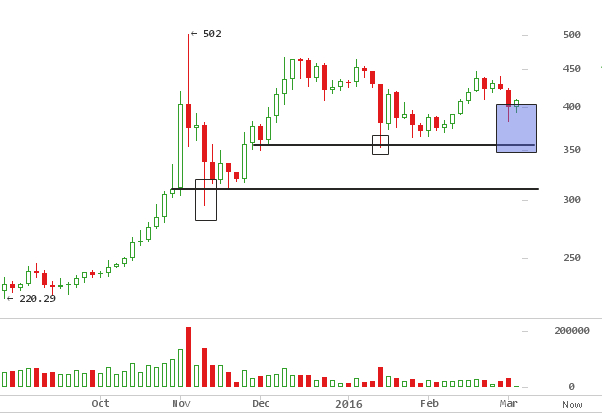

$385 may fail to hold, forcing price to the next stop at $352, a low

from January 16, 2016 break down. Right after, $310 sits from November

2015’s sharp sell off. Both highlighted on the chart below.

These levels are targets for further drops – currently $382, $352

right after and finally $320.

When Mike Hearn dramatically exited the bitcoin project, claiming it had

failed, price fell 15% on this sentiment. This was b-c within the wedge

triangle chart above, from $443 to $352. An uncanny resemblance was

this week’s drop, mired in all the doom saying on blocks filling up,

delayed transactions, and the scaling bitcoin community split.

Tvgiafi

on Reddit’s /r/bitcoinmarkets suggests:

“Market using the current sentiment to shake out those who thought they

were strong hands before the halving. Maximum pain, no free rides”

Coinbase CEO Brian Armstrong and Bitcoin Chief Scientist Garvin Andresen

both shared their opinions of discussions that took place on February 26-28, the Satoshi Roundtable in North America. They remain adamant on a

block size increase to 2 MB. The matter keeps resurfacing and there

doesn’t seem to be consensus.

Perhaps price will rebound off the wedge trend line like it did when

Hearn’s damning article came out. Or not.

Brian Armstrong, Gavin Andresen insist 2MB block size increase is necessary

Coinbase CEO Brian, penned a controversial article on his position on

the block size debate, after attending Satoshi Roundtable, an invitation

only high profile meeting of bitcoin heavyweights. In it, he voices his

concerns on Bitcoin Core’s Segwit and roadmap to 2017, and proposes

multiple teams work on the bitcoin protocol.

“the systemic risk to bitcoin if Bitcoin Core was the only team working

on bitcoin.”

Gavin Andresen was also clear on his

thoughts on

the attempt at consensus in North America, saying:

“If the block size limit is not increased, we will see more off-chain

solutions. It is, however, a symptom of an unhealthy network that is

becoming increasingly unreliable and vulnerable to attacks.”

Japanese Legislators inch closer to Bitcoin Regulation

Japan is the only country amongst the 7 major industrialized countries

that taxes bitcoin, an 8% consumption tax that was the subject of

discussion by Legislators at a lower house budget committee meeting.

Nikkei

reports the island’s Financial Services Agency will submit a landmark

plan on regulating virtual currencies to the Diet, the Japanese

Parliament.

It is interesting to observe countries competing on regulating bitcoin,

as a competitive advantage. Addressing the Finance Minister, Tsukasa

Akimoto, a member of the ruling Liberal Democratic Party said

“Can’t you consider not imposing consumption tax on bitcoins in line

with the international trend?”

Bitcoin Weekly Price Forecast

Bitcoin is at $412 as at writing this, up from $382, a marquee level.

Its still looks bearish, so could well trade in this zone for up to 2

weeks. $420 on the upper limit of the range, cut off on the lower by

$382. A shakedown to $352 would not be too far off. On this 3 day

chart below, a bullish count to $650+ is still in force in both

scenarios. A sell off to $352 would resemble (A) August 2015’s $192

hammer candlestick. It shakes out weak hands and triggers stop losses

set at $380.

Breaking $352 will be bearish, and will leave the gate wide open to

further drops to $300, at which point a re-evaluation of targets will

be required.