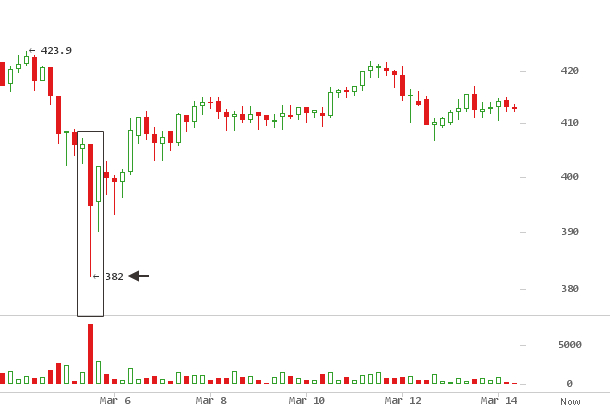

This week, the bitcoin price retraced back up above the $400 level,

from its $382 low on March 5, 2016. This low was the result of a sharp

sell off from $423, last week’s bearish price action. This week’s price

action has been limited to a $10 trading range, with $420 as upper and

$410 as lower bound limits.

It is clear on the above chart, $420 is a significant resistance

ceiling. It is also telling from last week’s action, a range between

$423 and $416, where it held as strong support for 40 hours before

succumbing to sell pressure, down to $382. The 3 day chart below from

Bitstamp highlights keys levels.

As of writing this, buy, sell order trades are settling at $413, right

below the $420 level. It dates back to December 2015, and a failure

here to break above it and turn it into support would result in a retest

of the lower level marked here at $352. Beyond this, key levels are

$450 on the upside and $300 on the lower.

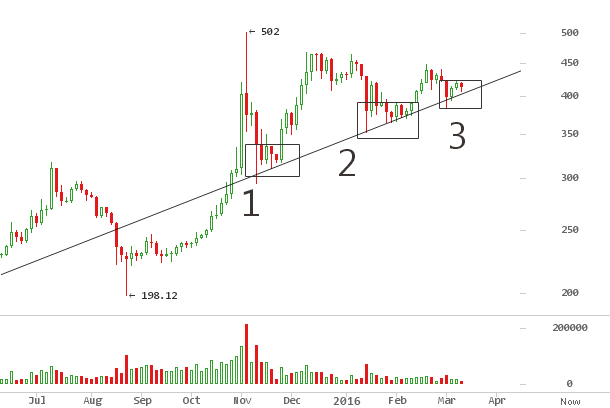

On the above 3 day chart from Bitstamp, a rising slope line dating back

to January 12, 2015 $152 low has been support for retracements down,

with price bouncing off this line at (1), (2) and this week’s (3).

Although not yet complete, (3) exhibits an uncanny resemblance to (1)

and (2). A second attempt lower at (3) is reasonable, just as at $300

and $352.

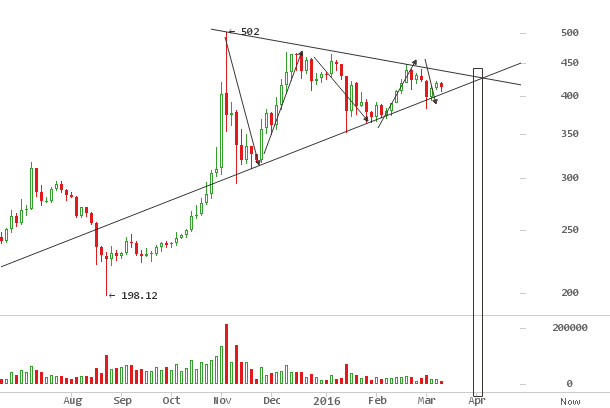

The prospects of a symmetrical triangle with high probability upside

breakout is looking more likely by the day. This 3 day chart above adds

a lower sliding slope line to make a triangle. Since November 2015

$504, price has oscillated within the bounds of both trend lines, with

a likely deadline convergence breakout sometime in April. Ideally, the

market should continue trending within the tightening end of this

triangle and break out to the upside.

On bitcointalk, traders are monitoring it closely:

“Still time for a false break, triggering stops in the process. As long

as the C wave low holds (352.5), triangle is still valid. The 390 hit

was lacking a completed structure, so I am still looking at the

possibility of more down, even if truncated, to complete the triangle.”

There could be a break lower upto $352, that would still maintain a

bullish probable count to $650+.

Coinagogo on

reddit

bitcoin markets is bullish based on an interesting pattern closely

resembling a post bubble technical pattern observed in the Russian

Ruble market since December 2014 to

June 2015 when it broke out to the upside.

“I expect a slow and steady rise beyond $500 from here. The decks are

clear of weak hands, and as evidenced by the lower and lower knee jerk

declines, the strong hands have been accumulating.”

There is however, an alternative bearish case, though, with a far lower

probability. Tzupy on bitcointalk suggests a break below $400 might

quickly turn bearish

“The big triangle held at 390$, but time is running out for the bulls,

so this time if 400$ will be broken, it should clearly break the

triangle down and cause a massive selloff.”

Japanese Corporations prototype settlements on Bitcoin Blockchain

On March 8, 2016, via a jointly released

announcement,

Fujitsu Limited, Fujitsu Laboratories Ltd, and Mizuho Bank Ltd revealed

success in trialing a cross border securities settlement system. By

using Bitcoin, final settlement was cut down from 3 days, was low cost

and minimized risk in price fluctuations. Mizuho bank Ltd, also a member

of R3CEV private blockchain consortium, provided expertise during the

trial period that ran from December 2015 to February 2016. Fujitsu on

its press

release

said

“Using the blockchain Open Assets Protocol, the three companies built a

blockchain-forming system in Fujitsu’s cloud environment, recording the

information from a confirmation (matched trade information: securities

name, quantity of securities, currency code, amount, country of

settlement, settlement type, settlement date) as one linked block.”

Ethereum crosses $ 1 billion market capitalization

Ethereum ETH cryptocurrency became the second blockchain asset to cross

a billion dollar market cap, alongside Bitcoin. Since january 16,2016,

the past 100 days, ETH price has gone up 10 times, and is now trading

over half of BTC’s volumes. As at writing this, ETH is priced at

$13.17, at a market cap of $ 1,023,800,217.

While Bitcoin is undergoing a block size increase debate, attention,

trader speculation and money flow has seemingly shifted to ETH.

On March 12, Honk Kong based bitcoin exchange Bitfinex,

announced it

will support Ether trading on its platform as from March 14th, with

plans to add shorting and margin trading features.

Central Bank RSCoin set to Rival Bitcoin

The Bank of England in conjunction with computer scientists from the

University College of London have come up with a proto currency design

for peer to peer transactions. Unlike Bitcoin, fundamentally designed to

be censorship resistance, RSCoin is a tool of state control and confers

monetary policy powers back to Central banks.

According to the

Telegraph,

“University College drafted the plan after being encouraged by the Bank

of England last year to come up with a radical design for a secure

digital currency.”

The success of this state controlled digital currency takes nothing away

from the value proposition of Bitcoin. Ultimately, Bitcoin derives its

value from its permissionless blockchain, censorship resistant and

artificially scarce digital asset.

Bitcoin Weekly Price Forecast

This week Bitcoin looks neutral to bearish in the short term. A second

attempt at breaking $420 and holding above it is in the offing,

possibly up to $426, but it should head back down after, as a

confirmation of $382 as the final low is necessary. As with both

rebounds off the rising trendline marked by (1) and (2) on the chart a

above, a double bottom is a solid foundation for any bullish take off.

Therefore, $390 – $400 will likely be retested.

Longer term, over the next 2 months, a bullish forecast is still in

force with target of $500 and thereafter $650. With the halving around

the corner, this convergence of events makes for an interesting outcome.