“Who wants to invest in a group of people who have two or three

conspiracy theories every week complete with ‘leaked documents’ and

theories about how all these outside forces are trying to topple the

mighty Bitcoin.”

===

That is part of a comment that a user going by the name Milly Bitcoin

made on the Coindesk news

site.

Just so you know, this was not one of those out of place comments, but

one that sounds and feels part and parcel of perhaps the most important

Bitcoin discourse of the week.

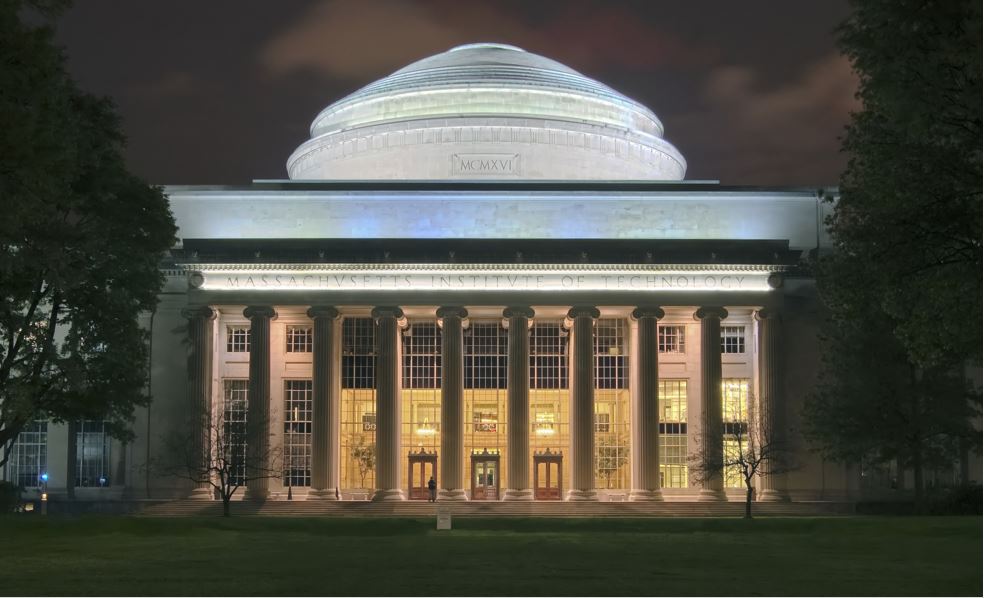

It was a reaction to an article about MIT responding to Peter Todd’s

allegations

that ChainAnchor, a project by the

latter, was meant ‘to get Bitcoin users to register their physical

identities and associate their transactions with those identities.’

Does the above comment have some or any truth in it? Is it really true

that the Bitcoin community-especially the developer group- is actively

in the business of creating and buying into conspiracy theories?

Ok. To deal with these-kind of-tough questions, maybe it is important

first to have a clear picture of things. We need to start telling the

story from its beginning.

Where it all started….

But before the ball starts rolling, I need to make this small note; we

are not using the comment above on this article because we take offense

with it or something. Just thought it is perfect for setting the stage.

Now, here is how it all began…

On Thursday, April 21st, 2016, Peter Todd, a renowned Bitcoin developer

and enthusiast who describes himself as a cryptography consultant on his

Twitter account, published a rather long blog on his official website.

In it was a warning to the members of the Bitcoin community. He had

apparently stumbled upon, or rather gotten wind that MIT University was

planning to bribe Bitcoin miners through the ChainAnchor, a Blockchain

project, so that in the end only bitcoin transactions associated with

registered users will be processed on the network.

“If ChainAnchor is fully successful to use Bitcoin at all you would be

required to first register your real world identity,” he explained on

his blog, “Your transactions would be linked to that identity in a way

that that a court order, or even a hacker, could uncover full details on

every Bitcoin transaction you make – your entire financial history, and

for that matter, the full financial history of all Bitcoin users.”

Evidence to support the allegations

He went on to share his evidence with the readers. He had leaked

slides

of ChainAnchor meetings and copies of the project’s preliminary white

paper. Apparently he had also gotten in touch with several people in the

know, and they had confirmed the existence of these plans.

MIT has refuted these allegations. Even so, the university has

acknowledged in a statement to Coindesk that its project involves

solutions for improving transaction identification in the set up like

that of Bitcoin.

But the university has asserted that these are not being designed for

Bitcoin. Instead, they are being built for private ledger projects such

as R3Cev.

“We published this months ago on a public website and keep updating it

at www.mit-trust.org. [But] ChainAnchor is simply not relevant to the

bitcoin discussion,” a spokesperson of MIT has told Coindesk in a

statement, “We also work on other flavors of blockchain, including

permissioned blockchains, [and] these are the kinds of blockchains

that a number of mainstream companies are beginning to implement.”

Users with strong positions on privacy

A few things stand out from this exchange, though. Of the most interest

is that privacy in Bitcoin is an emotive subject. It is also clear that

some members of the Bitcoin community are very vigilant in watching over

the privacy they enjoy while using Bitcoin. To an extent, this is

fueling a lot of mistrust among the actors in the space.

The question though is whether that vigilance is over-exercised.

Milly Bitcoin in her comment is clearly wrong on one account. There is

no doubt that investors must be finding the Bitcoin ecosystem not only

as a safe place to put their money but also one that promises the right

returns. Otherwise, they would not have invested over $1 billion in

Bitcoin startups in the last three years.

But he or she (we aren’t sure of the user’s gender) is onto something by

alluding that the Bitcoin community has allowed conspiracy to blur its

focus.

Bitcoin is a technology and more

Having stated that, it is important to acknowledge that Bitcoin is not

just an innovation. It is also a political movement. And where politics

is the game, propaganda is bound to find a home.

Consequently, some players coming up with conspiracy theories or reading

too much into words and actions of others becomes the order of the day.

In this particular case, it is also important to acknowledge as a fact

that governments, regulators and mainstream corporate establishment

around the world are jittery about Bitcoin. Many of them are wondering

how to put Bitcoin and the technology on which it under their control.

Thus looking at it from this angle, it is not farfetched for Peter Todd

to read a lot into what information he comes across from MIT or any

other player. He understands that in the context that Bitcoin exists,

conspiracies are possible. He might, however, not have the ability to

tell accidental patterns of actions from real conspiracies.

Conspiracy theories do not do any much hard

Back to the main question; has the Bitcoin community allowed conspiracy

theories cloud its focus? I don’t think so. While conspiracy theories

are being shared and discussed, everything is working just fine.

Investors are putting in their money into Bitcoin startups, hundreds of

thousands of transactions are going through, and developers and

entrepreneurs are churning out new solutions each passing day. Ok. Close

to each passing day.

Images courtesy of

Flickr

and

Wikimedia