The overall Bitcoin price move during the 4th week of the new 2016 is

definitely bearish.

After reaching $405.97 during the last hours of the 3rd week, the price

started the new week with a stronger decrease during decent trading

volumes.

Week 4 Bitcoin Price Behavior

===

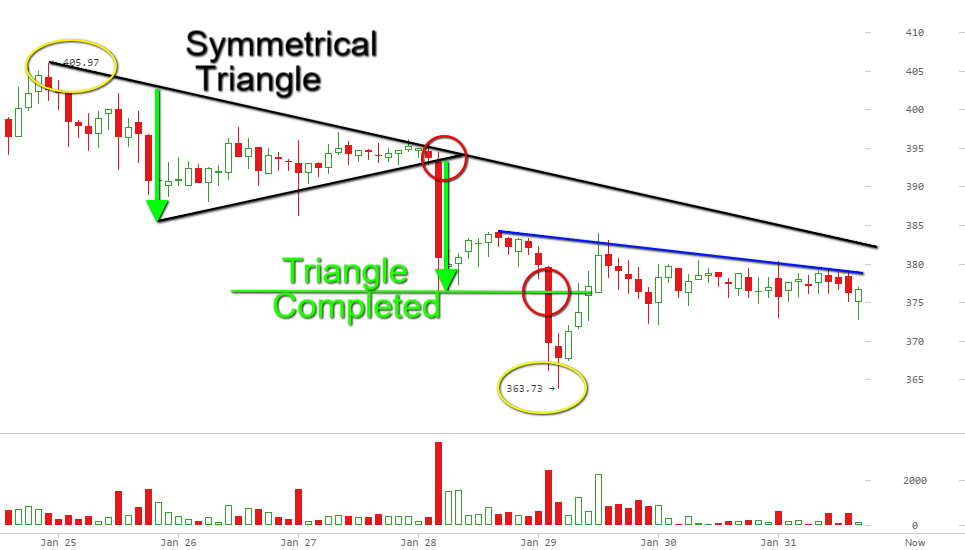

This is the H2 chart of the BTC/USD pair, which embraces the whole last

week (Jan 25th – 31st, 2016). The long black bearish line indicates the

bearish attitude of Bitcoin during the week. The bullish black line

marks the bottoms from Jan 26th to Jan 28th. As you see, the two black

lines form a symmetrical triangle, which got broken in the morning of

Jan 28th. A big decrease to $375 appeared as a result of the bearish

breakout in the triangle. This downward move completed the bearish

potential of the figure. After one day of correcting, the price spiked

down through the $375 support, creating the weekly low at $363.73.

The next four candles head the price back to the $375 – $380 area. The

subsequent price behavior has consolidative character. Bitcoin is

currently moving sideways, where a new interaction with the black

bearish trend line might occur.

In general, the price move during the last trading week shows us that

Bitcoin has no intentions to cancel its downward move.

Let’s now switch to the bigger view of the Bitcoin chart.

H4 BTC/USD Chart

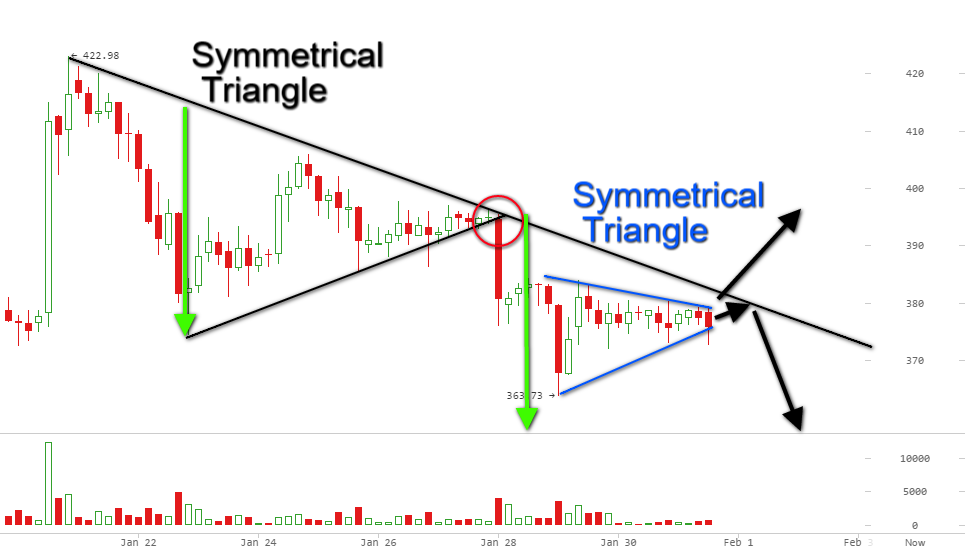

This is the H4 chart of BTC/USD, which

covers the period Jan 21th – Jan 31st, 2016. As you can see, the black

symmetrical triangle we discussed is even bigger. The bearish breakout

through the lower level of the triangle implies that the Bitcoin price

has a bigger formation to complete. However, the weekly $363.73 low is

not a sufficient target for the black symmetrical triangle. The price

needs to drop at least with $6.00 more below the $363.73 low in order

to satisfy the target of the triangle.

On the H4 chart the consolidation after the decrease looks like another

symmetrical triangle, which we have marked with blue lines on the image

above. The symmetrical triangle figure has the potential to push the

price toward a bigger move in an unknown direction. This means the

Bitcoin price could break upwards through the bearish trend, or the

price could enter a new trending move in bearish direction. In this

manner, we have two technical reasons to believe that the Bitcoin is

more likely to keep decreasing during the upcoming week.

First, we could say that the Bitcoin is already in the area of its

bearish trend despite it is not touching it yet. Since the price is

currently moving sideways, there is a big chance for another physical

interaction with the bearish trend. The H4 chart shows us that this

trend line is 4 times tested. Thus, we consider it as a reliable

resistance, which can sustain eventual bullish pressure of the price.

Second, as we have already said, the price has to drop below its weekly

low in order to complete the already broken black symmetrical triangle.

This means, if the price does another drop, it will confirm the smaller

blue symmetrical triangle, sending the price toward a new bearish move.

This is the second bearish factor which we take into consideration.

In general, the H4 chart speaks of a continuation of the weekly bearish

tendency.

Let’s now approach the even bigger picture.

H12 BTC/USD Chart

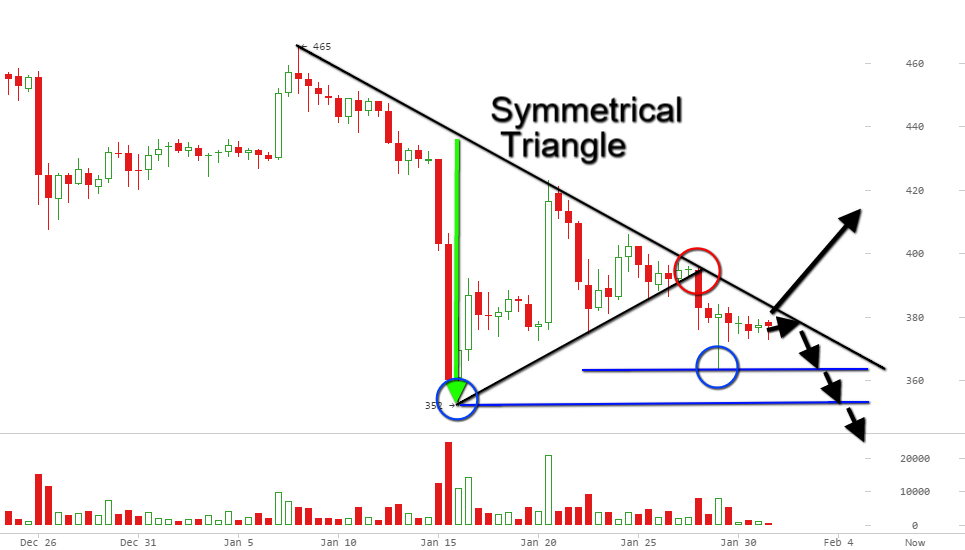

Above you see the H12 the BTC/USD chart, which embraces the period Dec

26, 2015 – Jan 31, 2016. This chart shows us the origin of the general

bearish trend, which we partially investigated on the H2 and the H4

chart. Also, the black bullish line shows us the entire symmetrical

triangle, which we discussed in the other two time frames.

It appears that the Bitcoin price is currently testing its bearish trend

line for seventh time. Since the bearish trend has resisted the price

for six consecutive times, we have a serious reason to believe that

another bearish bounce from this level is likely to occur.

The green arrow shows the size of the symmetrical triangle. After the

price broke the triangle in bearish direction, the overall odds show

that a decrease with the size of the formation might be on its way. If

this happens, the price will have two major supports on its way down.

The first one is the level, which indicates the bottom at $363.73. The

second one is the 2-month low at $352.00. The blue lines and the blue

circles on the image above illustrate where these two supports come

from.

Bitcoin Weekly Price Forecast

As you can see, all three time frames (H2, H4, and H12) support the

bearish idea. Therefore, we consider an eventual bullish break through

the bearish trend as an occurrence, which is less likely to appear.

Since the beginning of 2016, the Bitcoin price has been decreasing with

a consistent pace and our technical analysis concludes that this

attitude will probably keep going. It is a matter of a few candles until

the price touches the black bearish trend again. We assume that this

will push the price toward another bearish movement. If this happens and

the Bitcoin breaks its low at $352.00, the next bigger support will be

in the area of $317.00, which marks few bottoms from the middle of

November, 2015. However, since this level is pretty far from the current

Bitcoin price, we do not see this happening during the upcoming week.

The most logical Bitcoin target for week 5 of 2016 is $352.00 and

eventual break through this level.

Notice that the H12 trading volumes have been pretty low recently. This

means that another volume explosion might currently be on its way. When

the volumes increase again it will be up to the bulls and the bears to

decide the price direction for the following week. For this reason, stay

tuned and prepare for some action!