Bitcoin Price Report

This week, bitcoin broke out upwards sharply, from a low at $428 on

Bitstamp – the apex of a wedge triangle pattern. This step up happened

during early Asian trading hours, 5 am to 10 am GMT + 3 on January 7,

after global markets reacted to fall in Chinese stock market. This sharp

move triggered US and European market lows, with the British market,

opening at its lowest in history.

===

Gold and Bitcoin were the only assets that were up – XBT +6%, XAU +1%.

Bitcoin’s sharp rise topped off at $466, where it met a resistance that

has been tested once before on 3 day charts.

Volumes however, on Bitstamp, were subdued and do not inspire much

confidence on the strength of this leg up. When looked at on a higher

timeframe – 1D daily chart below – bitcoin is trading within a range

defined on December 12. In the grand scheme of things, the magnitude of

this move is typical of this digital asset, just bouncing up to the

upper limit of this defined range – $470 top, $406 bottom.

“Bouncing off of $465 yesterday should serve as a sobering reminder

that we are near the top of the range of $400 – $465. The market could

consolidate here for days to weeks and charge through or continue to

chop in the range for months.” says chewtoy on

reddit.com

This range coincides with a morning star pattern on the 1 day daily

chart, from November 5th, 2015 when price blew past 1 year highs. The

resulting wick (upper shadow) emphasizes the strong rejection by this

level. Therefore, breaking past this range will be a buy signal.

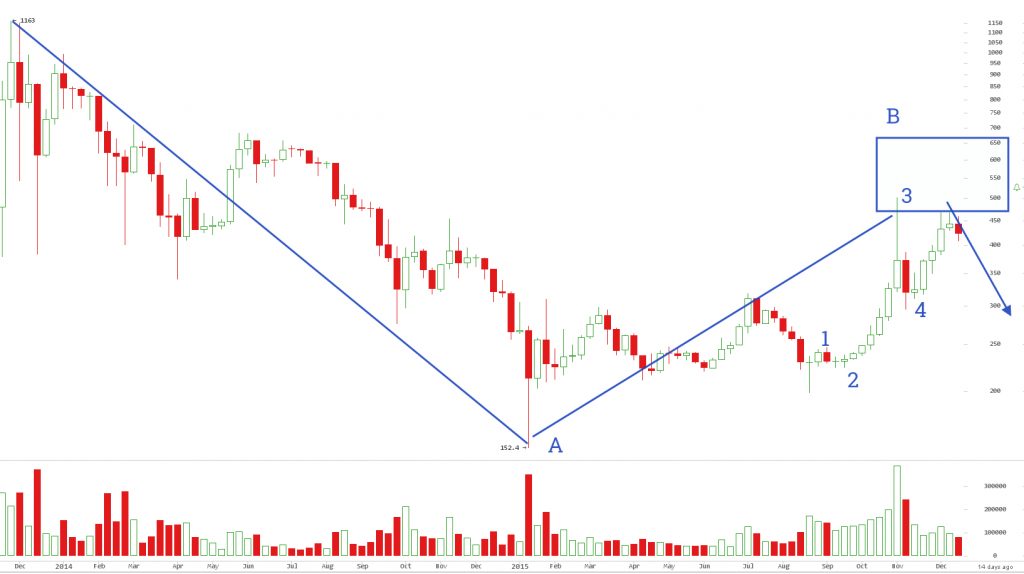

Relative strength momentum indicator (RSI), highlighted in blue

rectangles in the chart above, resembles November’s wedge pattern, below

50 before breaking out with price. Yesterday, RSI moved up above 50

simultaneously with the price. If they continue to move in tandem, we

could see more upside to $500 if a repeat pattern pans out. Generally,

I am cautious of repeat patterns, as it is in the nature of markets to

surprise the majority.

13 day simple moving average on the weekly is about to cut above 100d, a

bullish cross would signal higher price targets – $465+. In November

2014, the bear trend persisted after the 13 day cut below 100d. This is

only the first time the two average lines have come into contact again.

Meanwhile, 200d was a firm support over the course of 2015, rising

gradually together with 50d.

A rising support line from August’s low of $192 cuts across at $300 is

yet to be tested. A failure break above $465 potentially targets a

retest of low $300s – a low probability outcome at this point.

Bitcoin Markets React to Global Market slowdown

China’s capital controls and devaluing Yuan has been in the news,

alongside bitcoin. Markets this week were tumbling according to

Bitcoin Magazine:

“The price of U.S. crude oil declined 5.6 percent. The S&P 500 fell

26.45 points, or 1.3 percent to 1990.26. Nasdaq fell 55.67 points or 1.1

percent to 4,835.76. Britain endured its worst start to trading in 16 years.”

Bitcoin and gold notched higher, adding 6% and 1% in a day. Dips in

global financial markets are yet again reinforcing the virtual

currency’s role as a safe haven choice against fiat assets.

Martin Tillier writes This Time Bitcoin’s Price Increase is both

Logical and Sustainable

for NASDAQ blog, arguing that a large part of bitcoin price movement is

influenced by China:

“the percentage of trades against the Chinese Yuan (CNY) has been

creeping up recently, and stands at 81% for the last 30 days”

Chinese exchanges have been leading bitcoin exchanges over the past 3

months, a well known fact. Due to zero fees structure and opaque

operations, wash trades are high up the list of suspicions. Thus, it is

difficult to distinguish how much trading is real and how much is wash.

Bitcoin Block Reward Halving draws nearer, drives Bubble Speculation

With the clock on the next halving winding down, speculation on a

possibly new bubble is gaining traction. The market recalls what

happened before and after the last halving. Price went up 6X, 5 months

to the halving, and 10X, 5 months after!

In hindsight, it seems an obvious trade, but there is no telling if the

expected supply rate is fully priced in. The halving may induce a bubble

as part of the price discovery mechanism.

Indeed, if speculators drive a runup in price, this overarching theme

will feed back into market frenzy and build momentum. Sometimes, it is

not really about the fundamental reason, but FOMO triggering the

frenetic side of traders.

BITCOIN PRICE FORECAST

This week, I am cautiously bullish, and waiting for a clear signal to

get in if price breaks above $480. Because price is trading in a range,

a period of sideways trending may persist before a decisive move in

either direction. Therefore, if you do not have an open position, now is

not a good time to get into one.

“Price is in the middle of a range within a range at present, and a

position opened here at around $455 is almost certainly going to be in

profit and in the red multiple times in the short term.” – says chewtoy

on

reddit.com

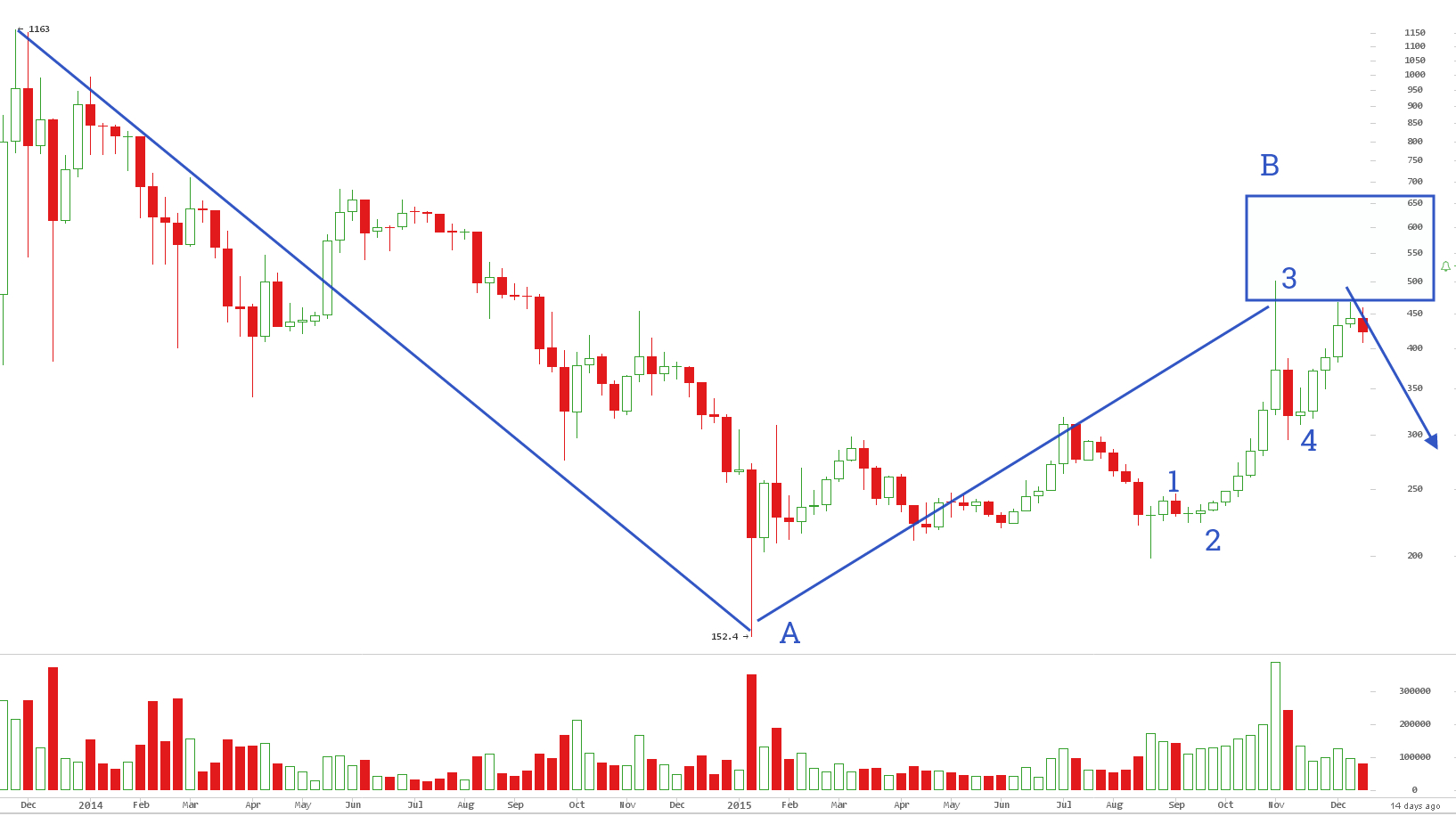

The medium term outlook depends on price action in the coming weeks

within the $400 – $470 trading range. There is still room for more

upside, upto $650 – $700, but, dependent on first breaking the $500

resistance level. A failure to breach $500 on this second attempt will

force price down to the next lower level of support at $300.

Halving speculation, expected on 18 July, could drive up prices up to

$703, a peak level from June 2014. Elliott wave chartists, have counted

4 of 5 waves up and the last 5th wave is unfolding now. It is not

uncommon for it to fail and form a short end, therefore $500+ prices

are not a foregone conclusion. What is important is to observe price

action here for further upside within the blue box highlighted.