The past 2 weeks of bitcoin, markets have been in a choppy sideways

action within a range with $422 and $363 as the upper and lower

limits. When price touched a low $352 bottom on January 16, 8am UTC, it

marked the lower bound of a range that has persisted for 3 weeks. A

strong retracement to $422 set a marker for the upper range.

===

These past 2 weeks have been uneventful, a series of give and take

between longs and shorts. The low of $363 on January 30th, 10pm UTC,

was quickly followed by successive rejections of this bottom. This

preceded a sudden spike to $392 on February 4th, 8pm UTC.

The current short term state of the market is indicative of the wider

ambivalence on resumption of the bull trend from $198 low of August 24,

2015, or a continued trend down from consecutive failed breaks at $502

and $467.

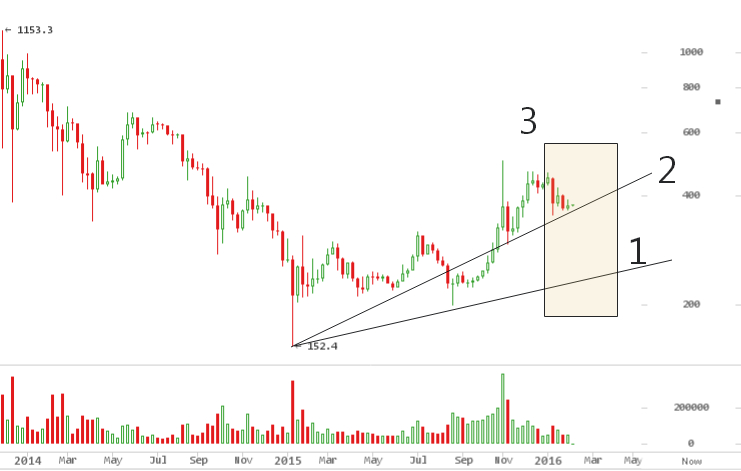

So far, on the 3 day chart, a symmetrical triangle pattern is seemingly

taking shape, consolidating within two converging trend lines. In

technical analysis literature, this triangle is frequently grouped under

continuation patterns. Patterns that signal a consolidation period

within a trend, followed by a resumption of the prior trend.

As the price approaches the apex, an imminent breakout draws nearer, as

early as the second week of March. In the event of a breakout, an

increase in volume follows the direction of the breakout.

This weekly chart above captures the decisive point of the market (1)

and (2). Trend line (2) from January 12, 2015 $162 low cuts across

$350, the most recent low. If it holds,the trend should creep up the

upward slope. On the other hand, $250 is the next logical level on

failure of $350 support. Here sits another trendline from the $162 low

in January 12th, 2015 and $198 bottom on August 24th, 2015.

In both scenarios, price would bounce off the trend line and resume an

upward trajectory to $600, just in time for the reward halving with all

the fanfare. The market is expecting halving speculation to stimulate

price into a bubble. $350 and $250 are the price levels to watch.

As seen in this chart above, price sits at 38% Fibonacci level marked by

(3), a retracement from $162 January 12th, 2015 low and 16 month high

at $502 from November 2nd, 2015.

The first time this level was tested was (3) on January 16th, 2016 from

where it bounced off, so another test of this level is due for a double

bottoms, common for asserting levels to launch from. Similar to (1) and

(2) highlighted above.

A double bottom can also fail and lead to capitulation to a lower price

level.

Blockstream secures funding to commercialize Bitcoin blockchain

This week,

Coindesk

reported Blockstream’s $55 million Series A funding round, a vote of

confidence for bitcoin ecosystem and its utility as an open source

permissionless ledger. Over the past year 2015, the hype around private

blockchains has seen banks form consortiums to build out their own

private ledgers, such as R3CEV backed by over forty large cap commercial

banks,

In the long run, increasing the utility of the Bitcoin Blockchain is

bullish for price. For CEO Austin Hill, building bitcoin’s open source

tech is not mutually exclusive to Bitcoin philosophy, because the

codebase can become more relevant for commercial applications.

In the same week, the startup announced through its

blog

a strategic partnership with PWC, saying

“Together, PwC and Blockstream will help companies evaluate

cryptocurrencies and blockchain technologies and launch new uses for the

Bitcoin protocol.”

The success of Bitcoin, and ultimately its price, is dependent on

valuable use cases of the underlying blockchain. It is a crucial

fundamental piece for long term price.

Ethereum Up 90% over 2 weeks, $3.00 per Ether

While Bitcoin has been undecided on whether to go up or down, Ether has

crept up over the past weeks since January 24th, 2016, on the back of

great news, R3CEV using Ethereum tech in their recent proof of concept.

ETH has now surpassed Litecoin in market cap on heavy volume, now at

$230,304,325 market capitalization, trading at $3.00 a piece. Already,

comparisons with Bitcoin have surfaced. A

tweet

from George Hallam

“Just 4 months after release, Ethereum already has ~1/4 the number of

nodes on the bitcoin network (1354/5712)”

It comes at an interesting time, when Bitcoin is going through an

apparent crisis. Speculators may use this to fuel BTC dumps and ride ETH

for a while.

380 nodes show Support for Bitcoin Classic

Bitcoin’s seeming crisis stems from a community dispute over conflicting

proposals to raise the block size limit. Bitcoin Classic, a hard fork

proposal to

increase the transaction processing capacity from 1MB to 2MB, is

garnering support with 380 nodes running it so far as per

coin.dance

The risk of a hardfork is systemic, and would send markets into panic

selling, at least until the dust settles.

Bitcoin Weekly Price Forecast

As of writing this, price wobbles around $377. The choppy, indecisive

action from the last 2 weeks is set to continue. This chart illustrates

expected range bound action between $365 and $390 until a break out.

As outlined earlier, the larger trend here dictates short term price

limits, as its eventual outcome bids time.

Price has broken below the 50 day and 100 day exponential moving average

(EMA) lines on all timeframes: 1 hour, 4 hour, 6 hour, 12 hour and 1 day

charts. This chart above shows one exception, the 3 day chart, after

bouncing off the 100 day EMA line as support. Price is not out of the

woods yet, the other exception as the weekly chart shows below.

Both the 50 day and 100 day EMA have been crucial in defining direction

of price while acting as support and resistance at (1), (2), (3) and now

approaching (4). Above is the weekly chart showing expected bounce off

trendlines at (4). Together, they cut across $327.

$327 is therefore a reasonable target for on a breakdown of $353

support. Smart traders could easily take advantage of this level and

push it lower to shake out weak hands. Often, levels are breached

sharply in cascading selloffs, only to resume above or below rejection

levels and leaving behind long wicks. The $504 high in November 2nd, 2015

is a perfect example. Whilst the high was $504, the true level was

$463.

An allowance from $327 to $300 is wise.