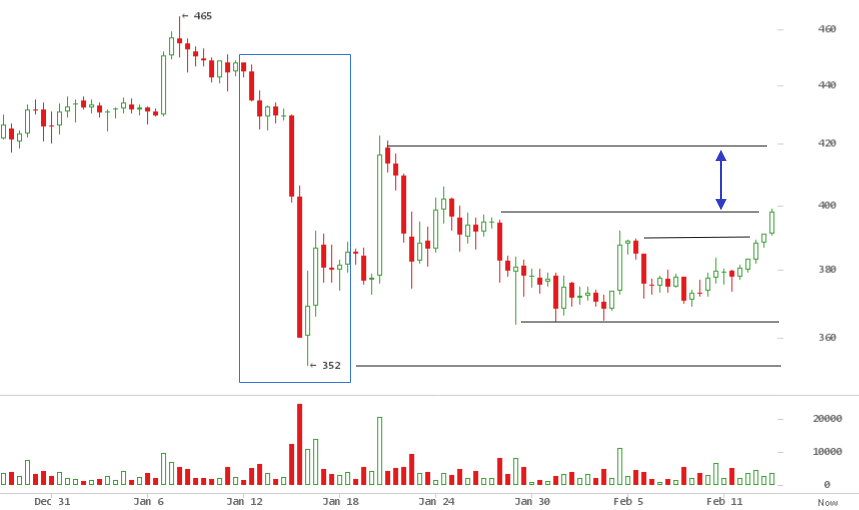

This week on February 9, 2016, price launched off $370 in what looks to

be a reinvigorated attempt at claiming back lost high levels.

Consecutive green candles have broken above $390. It is still too early

definitively say price is off to the races, as $400 and $428 levels

are yet to be broken. As of writing this, price is at $399 and should

break $400 soon. Consolidations before breaking significant levels are

typical. Therefore, shallow retracements or sideways trading ranges at

these levels are reasonable. At times, markets needs to build momentum

before another leg up.

Since last week’s weekly price report, the bitcoin markets have

seemingly found a solid bottom to launch a retrace up to $450 high.

January 8, 2016 was the last time price was above $450, right before a

sequence of cascade selloffs led to a $352 price low on January 15,

2016.

This looked to be the early start of a bear trend, but, in the

weeks that followed, this $352 support has held strong as the lower

limit of a trading range. The upper most limit of this range has been

$428.

The chart above, shows (1) on January 12, 2016, when cascade sell off

preceded $352 low. Price broke sharply below 50 day and 100 day

exponential moving average (EMA) trend lines. What followed was attempts

by the market to regain momentum for continued trend up from December

2015, (2) and (3) was the market’s attempt at breaking up above periodic

day moving average lines. Both times resulted in rejections, whilst the

lower trading range limit at $365 held.

This week, (4) price successfully broke EMA resistance to go up above 50

day and 100 day trend lines. The green candlestick above the yellow 100

day looks solid so far and should hold steady for another leg up.

Ideally, a complete positive bullish return requires a bullish cross

where, the blue 50 day EMA cuts back above the longer term 100 EMA. In

bull trends, moving average lines align in order of short term lines

above long term lines.

The chart above plots 50 day and 100 day simple moving average (SMA)

lines on the 12 hour chart. Here, just as in the EMAs, price broke below

both average lines at (1). It has been levelling on $365 base support

for 4 weeks, attempting to reverse trend at (2) and (3).

(4) shows price sitting above 100 day SMA, and is now headed for yellow

100 day SMA that cuts at around $404. It is reasonable to expect some

resistance at this level (if any). The real prize however, is a bullish

cross where blue 50 d SMA cuts back above 100 d SMA, reversing the bear

trend at (2) when the short term trend line cut below long term trend

line, a bearish cross.

On this chart above, since the January 12, 2015 capitulation low at

$152, and the 14 month peak high at $502 on November 2, the market

retraced to 50% fibonacci level, but spiked down 61.8% fibonacci level

first on November 9, 2016. A second attempt at the high from this level

found resistance at $468 on December 10, 2015, a double top failure

that fell to 38.2% fibonacci level. The highlighted level here lies

between $368.45 (38.2% fib) and $419.49 (23.6% fib).

This chart above zooms in on this zone and paints a better picture of

the next level of resistance at $420, after 38.2% level formed a strong

base, reasserting support multiple times. Expect some resistance at

$420, similar to January 20th.

Bitcoin Block Size Debate takes a turn

This week, a group of influential companies met in a ‘Bitcoin

Roundtable’ to discuss the path forward for raising the controversial

blocksize limit. Arguably the single biggest debate in bitcoin’s short

history, raising the block size has split the community and developers

into factions, all pushing alternative paths to increasing block

capacity.

Despite its official release on Tuesday 9, February 2016. Bitcoin

classic, the latest hard fork proposal out of the starting block, was

rejected by the consortium, who collectively represent 60% of hash power

on the Bitcoin network.

In an open letter published on Bitcoin

Magazine,

the group said

“We think any contentious hard-fork contains additional risks and

potentially may result in two incompatible blockchain versions, if

improperly implemented. To avoid potential losses for all bitcoin users,

we need to minimize the risks. It is our firm belief that a contentious

hard-fork right now would be extremely detrimental to the bitcoin

ecosystem.”

Instead, they backed the proposed roadmap by Bitcoin core, a less risky

soft fork with additional improvements and capacity increase via

Segregated Witness

“We see the need for a modest block size increase in order to move the

Bitcoin project forward, but we would like to do it with minimal risk,

taking the safest and most balanced route possible. Segregated Witness

is almost ready and we support its deployment as a step in scaling.”

Bitcoin’s price is highly dependent on the state aof the network.

Forking is a systemic risk that suppresses the true price of bitcoin.

The recent debates have led to capital outflow to Ethereum.

Ether price shoots up 150% in 5 days

Price shot up from 0.00683 BTC per Ether to 0.01711 BTC per Ether in

under 5 days. Ethereum is now second only to Bitcoin in terms of market

capitalization, now at $423,457,521, trading at $5.50 per Ether.

Over the month of January and February 2016, it has overtaken both

Litecoin and most recently Ripple, as speculators moved to trade the

cryptocurrency while Bitcoin was caught up in its block size woes.

Bitcoin Weekly Price Forecast

This week price should at least go up to $420, where there is an an

evident level to be overcome. The market looks intent on recapturing

higher price levels, after breaking out from a local triangle.

For caution’s sake, a re-evaluation may be necessary once price hits

$420. A larger symmetrical triangle is still in force, and has held

well so far, as seen in the chart above.