On January 14, 20:00 hours UTC, bitcoin price broke $430 level

support, falling sharply to a $352 low in a series of cascading sell

offs. The chart above, on a 12 hour time frame, shows an impulsive red

candle stopped short at $358, a support level where price has

consolidated.

Bitcoin news outlets and traders are blaming this 18% decline (as of

writing this) since Friday, on controversy surrounding Bitcoin Protocol

soft and hard fork disagreements. While not wholly responsible,

speculators will sell the news if it carries weight.

Since exactly one year ago, on January 12th, 2015, the bitcoin price

has retraced 23% of its $162 – $502 year uptrend. After encountering

resistance at $500, retracement found support at $300, but failed to

recapture highs at $473 on a second attempt. This sell off broke below

23% to 38.2% Fibonacci level.

From my experience trading bitcoin since 2011, moves that come after 6

weeks of sideways do not typically end the next day; this level may fail

to hold. BitKrow13 on reddit

suggests:

“there will be support at 2300 Chinese Yuan ($350 USD), if it breaks

below that level, i see a major move down to 2000 Chinese Yuan ($300

USD)”

The chart above is a 3 day chart showing 13 day and 50 day simple moving

averages (MA) over price candles. In April and July 2015, price peaks

attempted to break above MA resistance unsuccessfully. However, a

bullish cross in October, which occurs when long term MA crosses above

short term MA, confirmed a change in trend to the highs of end of 2015.

The most recent bearish turn, fell sharply from 50 day MA. 13 day MA

sits below price fall at $320 – $300. It is a reasonable next target

after a bearish flag pattern forms on consolidation. chewtoy on

reddit

says:

“I think we are going to see bear flag after bear flag all the way down

to $300. If $300 doesn’t hold, it’s going to be a freefall to $250

and then it’s anyone’s guess.”

On this chart, it is evident momentum has flipped to oversold condition

(below 30), contrary to a similar pattern between November and December 2015. With benefit of hindsight, price will not go up as it did over

November. We could easily see a double dip in RSI within oversold

levels, resulting in prices dipping lower the $353 support level.

Bitcoin Price Plunges 15%, on ‘Failure’ Claims

Ex Core developer Mike Hearn, was interviewed for New York Times

article

saying “ he’d sold all his coins”. Along with his article on medium,

where he writes “Bitcoin is a failed experiment”, it has catalysed

opinions on forking, scalability issues and a toxic community.

Naturally, these sentiments led to speculation, either through panic

selling, or induced panic triggers that cascaded into self fulfilling

dumps. On January 15th, 10pm UTC, price fell off a cliff, from $431 to

$352 over the next 24 hours. Forum conversations on the protocol only

intensified the sell spiral.

The Bitcoin protocol is fundamental to this asset, systematic risks have

to be factored into price. Long term investors looking at a shot at

bitcoin, are on the fence right now.

Cryptsy claims insolvency, admits to 13,000 BTC Hack

In a newly released blog post, Cryptsy

exchange came clean on why customers have had trouble making

withdrawals. On June 2014, 13,000 BTC and 300,000 LTC totalling $9.6m

at the time, were stolen through an IRC backdoor trojan. The exchange

now says it could file for bankruptcy, with 10,000 BTC ($4.15m) in

outstanding liabilities.

The timing of this news was great for shorters, and fuelled selling

pressure on a day the market fell 18% (as of writing this) amid network

failure claims.

Ethereum surges 33% on weekly

While Bitcoin hogged the limelight, Ethercoin secretly went up 33% from

a $74,567,536 market cap to a $99,354,117 high, all in under 1 week.

As of writing this, it is trading at 0.003441 BTC, $1.28 at current USD

rates.

Interestingly, ETC trading volumes are inching closer to Litecoin. Ether

could soon surpass Litecoin as the 2nd most traded cryptocoin after

Bitcoin.

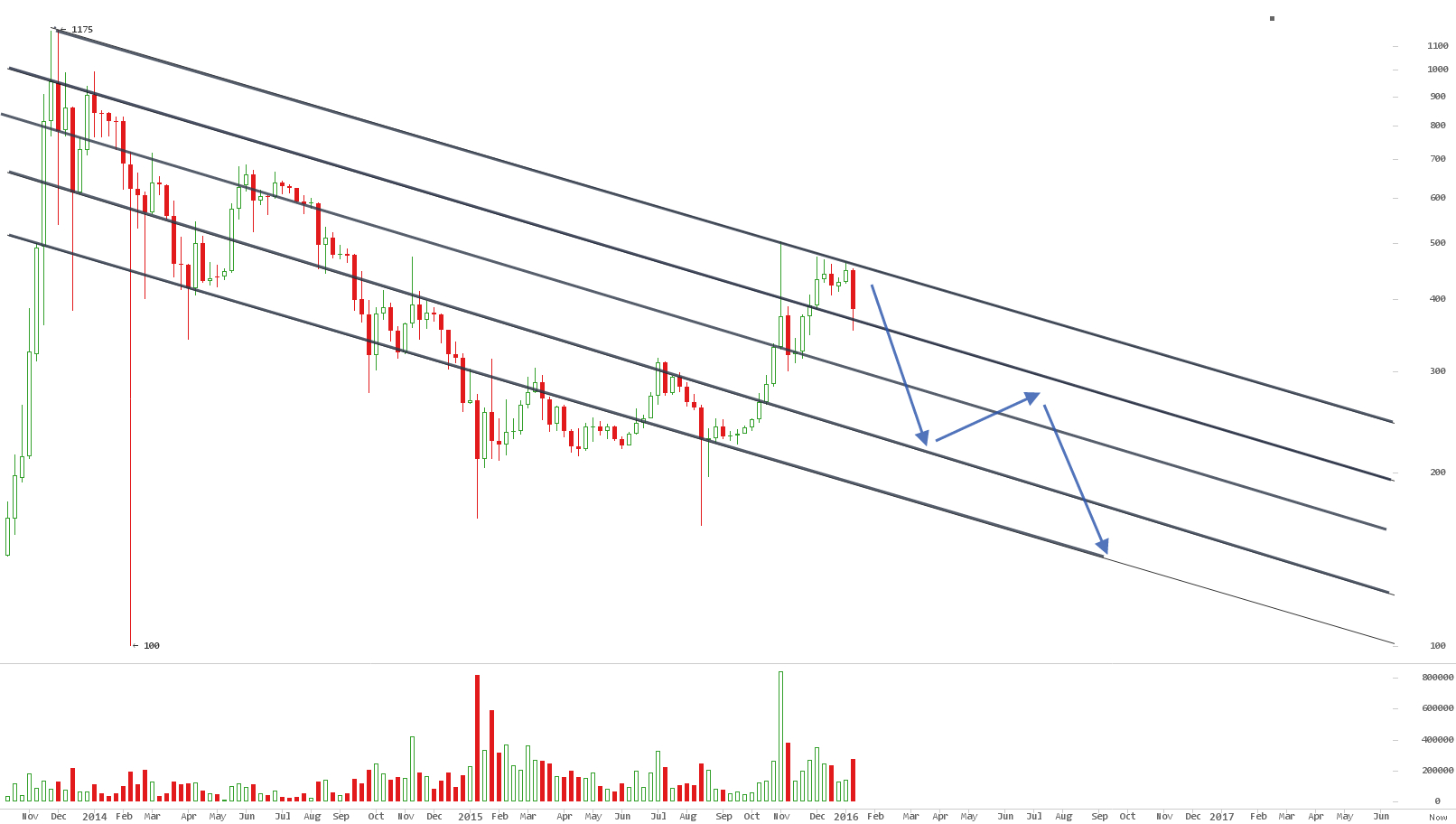

Bitcoin Weekly Price Forecast

This week the price of bitcoin would seem bearish. Dumps are likely to

continue until the market finds support at $320 – $300. In this chart

(3) marks this level. Since the late August 2015 low at $198 on

bitstamp, price has respected a rising slope as support (1); so far its

has held but, it is now on the brink of breaking out at (2).

It will not succumb immediately, and we might see price linger at this

point for some days (or week), in form of consolidation rising up the

slope. Perhaps a range between $353 and $390. However, this will be

temporary, before the inevitable downtrend resumes.

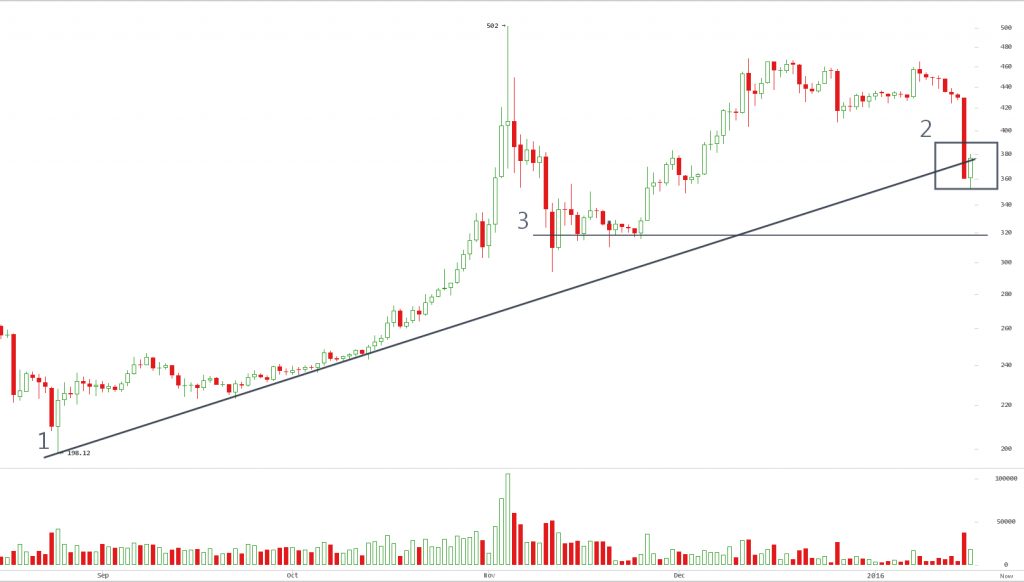

In the coming weeks, we are likely to witness 5 wave patterns down, like

previous peaks at $671 in July 2014, $475 in November 2014, and at

$316 in July 2015. 5 waves down is a common Elliott Wave pattern of

trending motive waves. The chart above highlights the double top

reversals.

With this in mind, targets on continued downtrend are $350, $300. Even

$250 is a realistic support target at this point. This week’s events

have shifted the trend to an all out bear; it is now really a matter of

picking out the bottom.

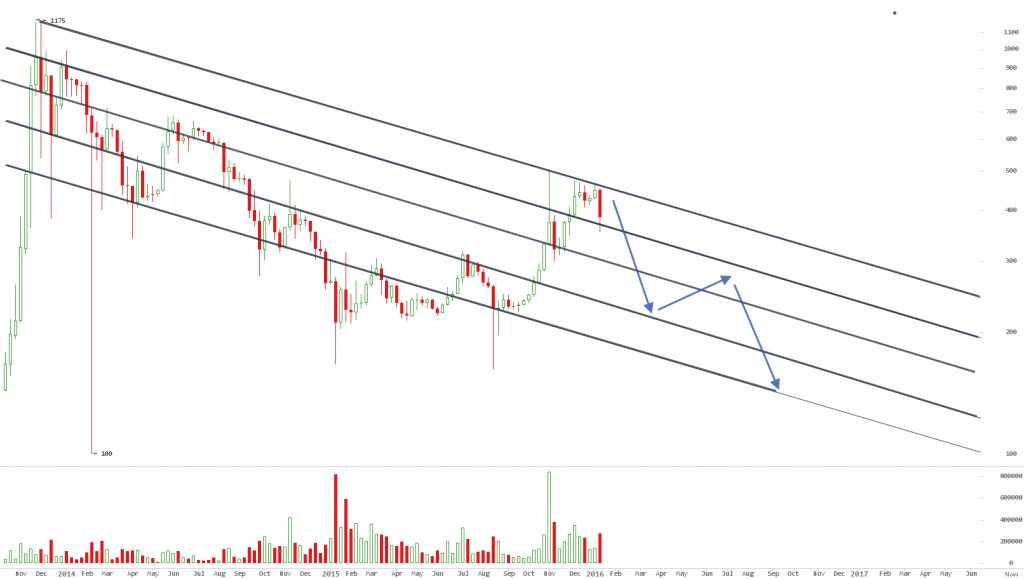

In the longer term, the blocksize debate over a soft/hard fork route

to increase capacity will continue to cast a shadow over price until it

is resolved. If this week’s events are anything to go by, forks are a

systematic risk. Bitcoin investors are aware of the potential

implications of such an event on price. Therefore, in the medium term, I

am looking at the blue arrow on this chart as a path to as low as

$200.

Perhaps an agreeable solution will be arrived at, and implemented over

the next 6 months, lining up perfectly with the block reward halving

expected in July. Just in time to lift price from a bottom.