There is nothing quite like a Happy new year and $1000 Bitcoin, to cap off what has been an amazing past year for Bitcoin investors. In a matter of 30 days, Bitcoin has had a phenomenal run rising +29%, from $800 on December 17 to $1032 on January 2, 2017. The market capitalization of Bitcoin surpassed the $16 billion mark, taking a stunning pole position for the decisive best performing commodity and currency awards in 2016. Bloomberg, Reuters, CNBC covered the digital asset’s impressive rise over the past month, ebbing away the skepticism of new investors. Buyers coming in this week, from this renewed wave of interest, will possibly only ever marginally heard about this niche market.

===

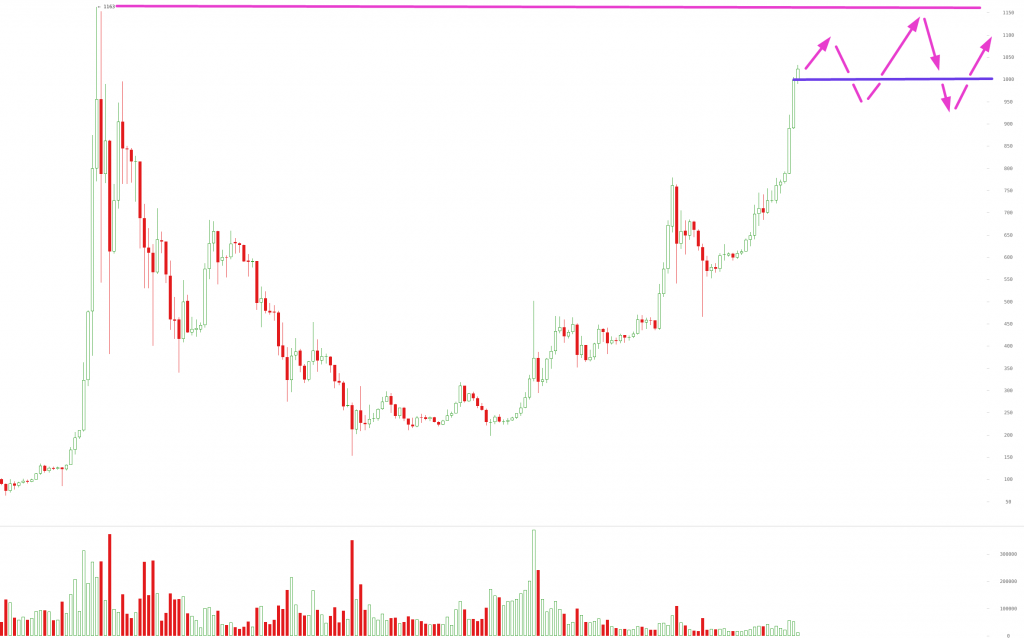

As at writing this, BTC is trading at $1023 on bitcoinaverage.com, after correcting from the $1032 top. The market is correcting sideways, in what might turn out to be a reasonable entry for latecomers. Investors are waiting for Bitcoin to cross the last all time high at $1163.

The 12 hourly chart above shows the month of December was bullish. On the last price analysis a little over a month ago, a series of higher highs was building up under $760, cocooning into a rising wedge pattern. $750 had proved difficult to breach. At the time, a dip to find a low to bounce off of was the high probability outcome. 9 times out of 10, this pattern breaks down, before resuming the uptrend. So the general consensus was a break down first, before resumption of the up trend.

Vinny Lingham, an expert trader, encapsulated the ambivalence of most investors tweeting.

“We will shoot past $800 very quickly, or drop back to $700s. Any drop to $700s would be short lived.”

Well the wedge broke out upwards, price cruised past $800s 20th December, and further up to a $875 high at 2, Bitcoin’s strongest level since 2014. Price consolidated into an ascending triangle over 15 hours, just before Chinese traders were waking up in across Asia. In under 3 hours, they had pumped price to $920; Bitcoin was now trading 107% higher, outperforming every major currency, stock index and commodity contract in 2016!

$920, a yearly pivot, doubled up as top of an elliott wave 3. A 3 wave retracement pulled back to the prior consolidation level at $860, where a fibonacci level and a bullish engulfing pattern marked the bottom. The next wave ran past $920 to $984, before correcting back down to $930 and pushing up past $1000 on the first day of 2017.

One of Wall Street’s most curious investment, had come out on top once again, rising +134% in just 13 months!

The Rise of Bitcoin in 2016 as an Investment Asset Class

After declaring Bitcoin as commodity next to Gold in 2015, the CFTC launched a pair of USD price indices in 2016. They will track the USD price of Bitcoin and could be used s building blocks for futures contracts. Financial products backed by Bitcoin are going to be important for access, liquidity, and price stability. The WinkleVoss planned COIN ETF and Barry Silbert’s Bitcoin Investment Trust (BIT) were great examples of strides in 2016 for non-tech folks to get involved.

Macro Economic Factors Drive Bitcoin Demand

Venezuelans, Zimbabweans, Nigerians and the Chinese reminded us of the qualities of Bitcoin that give it its value. The devaluation of currencies by Venezuela, as high 62% for the Bolivar, reinforced the need for an alternative currency beyond the reach of government. China was linked with Bitcoin outflows as a capital control evasive trick. By investing into large mining farms, depreciating Yuan is legally turned into newly mined untainted Bitcoin.

Still in Asia, India’s widely publicized demonetization overnight policy, reminded us the war on cash is real. Governments are intent on a cashless regime with the People’s Bank of China and Bank of England publicly endorsing fiat based digital currencies. But, this only strengthens the case for a digital cash alternative, an independent decentralized digital currency.

The future of Bitcoin is looking brighter by the day. 2017 holds great promise.

BITCOIN PRICE FORECAST 2017

The general feeling across trader’s forums is bullish, despite the already exceptional rise up. Bitcoin experts, analysts and the community seem to agree the last all time high, $1163 is the next leg up.

$1163 is both a psychological stratosphere level and a 100% fibonacci extension of the whole move up from $162 bottom, anything seems possible. The current consolidation just below $1032 is a short one at best, before testing the famed all time high resistance. I expect a break of this level in the coming days. At this level, the fear of missing out from buyers, a new year and the excitement of bitcoin holders will cause a spike. All cards are on the table up to $1300.

But it is important to be cautious of peak sell offs from this parabolic rise, as a combined effect of profit taking by holders since the last all time high (ATH) in 2013, position traders from lower levels and margin traders leveraged long with exits set at the all time high. If price does break this level, then the murky unprecedented levels will excite traders to the possibility of a massive bull run, similar to the 2013 run up from $126 to $1163. I am sceptical of a similar occurrence.

This year however, I expect volatility to smoothen out and stabilize as the effect of steady growth kicks in. Protocol development seems be on track with Segregated Witness now at 45% adoption by nodes. Bitcoin is growing up! Without a doubt , Bitcoin is poised for a rise to $2500 by the end of 2017.