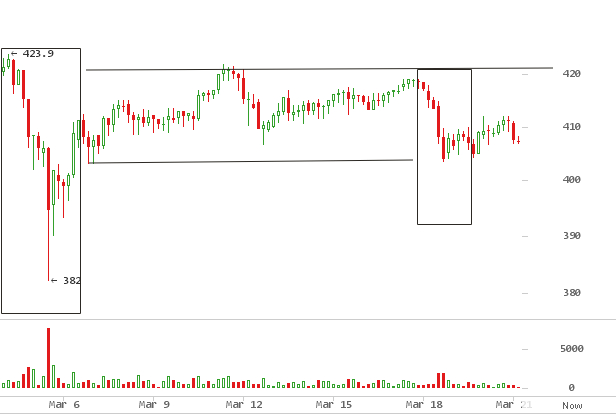

This week the price of bitcoin traded within $400 and $420 range seen

on the 4 hour chart above, moving sideways for most part of the week.

Last week’s short run up from $382 to $420 was the first attempt at

breaking $420 price ceiling. This resistance level was retested again

this week but, failed again at $419. This rejection forced priced to

retrace lower, back down to the lower limit of the trading range at

$403. As of writing this, price sits at $407, and is seemingly headed

to retest the lower $403 support again, the third time. A double bottom

on the 1 hour chart bounced off $403 and $404.

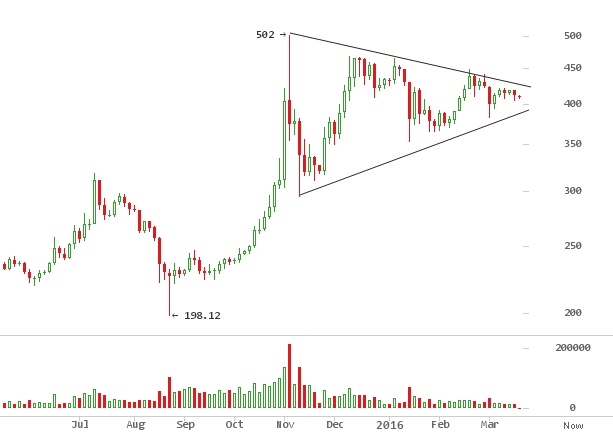

This chart above of the 1 day on Bitstamp is a fibonacci extension from

the $198 low in September 2015. It stretches up to the $504 peak in

November. Since January 14, price has been trading between $430 and

$385, 23% and 38.2% fibonacci levels respectively. This range dates

back to the beginning of 2016, with offshoots on the upper and lower

bounds. It is a decisive range, and the market seems trapped between

breaking up above $430 and heading back down below $380. Last week’s

low bounced off $382 and this week, it has mostly been trying to regain

territory. Until $430 is breached, the trend here is bearish.

This 1 day chart above marks out the most critical levels in the coming

weeks. $430, $450 and $500 on the upside and $350 and $300 on the

downside. $400 is most significant presently, a failure to hold support

this time will fall through to $350.

This symmetrical triangle above on the 3 day chart, with a base back in

November 2015, is still in effect and holding. Both the rising and

downward sloping trend lines are squeezing price to a converging break

out point. Price is bound to break out soon, in a matter of weeks;

question is what direction it will break.

This chart of the 1 week, captures significant price levels dating back

to June of 2015, fused with price projections on either upper or lower

breakout and marked in arrows. $680, a resistance level from June 2015,

is a reasonable upside target if price makes a bullish breakout from the

triangle. $400 level is critical, as a level that failed to break in

August through October 2015. Breaking this level would be incredibly

bullish.

The downside target is $352 first, followed by $300, a resistance

level that pushed back on price over most of 2015, until it succumbed to

buy pressure in November 2015. Resistance turned to support the same

month, and offered a firm base for a retracement to the current price

levels. A bearish breakdown will follow through $300 to a rising

trendline at $250.

Bitcoin finds a place in Mainstream Fund Portfolios

According to

Reuters,

professional traders, mutual funds, hedge funds and family wealth

offices are adding this nascent digital asset into their portfolios. Its

unique properties, growth potential and low correlation with other asset

classes, has added diversity and boosted returns.

A managing partner at London’s Ledger Capital, Jeremy Millar says the

blend of bitcoin investors is skewed

“50 to 90 percent of bitcoin’s current $6.4 billion market cap is held

by near-institutional money such as individuals at hedge funds and

family offices. That has not changed over the last two years.“

But, this is changing with the emergence of funds purely dedicated to

Bitcoin, propping up its legitimacy for investors on the sidelines.

Pantera Bitcoin Fund and Grayscale Bitcoin Investment Trust are

pioneering this neo asset class on the fringes of Wall Street.

Bitcoin boosts returns as part of a Diversified Portfolio

Grayscale Investment, sponsors of the first publicly – quoted bitcoin

securities, the Bitcoin Investment Trust, published a

report

on the impact of adding bitcoin as part of a diversified portfolio. Some

interesting patterns emerged, like a boost in returns, when compared

with portfolios without bitcoin; in particular, its low correlation with

mainstream assets and growth potential.

“Modern Portfolio Theory suggests owning non-correlated assets can help

mitigate downside risk”

Bitcoin Weekly Price Forecast

This week, price looks bullish in the short term. After bouncing off

support around $400, last week’s $382 and this week’s, $403, a retest

of upper resistance at $420 is likely, and will break after a third go

at it. The target this week is $430 zone. At this point, a downward

sloping trendline should force down price back within the triangle. The

symmetrical triangle highlighted above will drag on until uncertainty on

which direction it breaks out reaches peak.